The most significant financial aim is saving for retirement. It’s never too early or too late to start retirement savings but mostly People save too little or too late. You can undertake some measures to make sure you're ready to spend your later years

financially, regardless of whether you're starting or almost retiring. Follow an age- appropriate strategy to significantly boost retirement savings and be ready for a comfortable future.

Here are the key plays for building your retirement account at every age and stage of life

1. At 20: Get an Early Start, No Matter How Low

In your 20s, you should begin saving for retirement in this manner. Retirement may seem, at this point in your life, like an eternity away, but it is indeed at that point that you can maximize the potential for compounding interest where your money makes money for the sake of having more money in the future.

Key Points:

Contribute to an Employer-Sponsored Plan:

If your employer offers a 401(k) or any other plan, contribute enough to make your employer add any matching dollars.

Open a Roth IRA:

If there is no plan from your employer, or in case you simply require some more savings, establish a Roth IRA and pour money into it to gain tax-free.

Automate Savings:

Have an automatic transfer setup from your checking account to retirement account, so you will end up contributing consistently in the long run.

2: Once you are in Your 30s: Contribution Should Increase When Income Goes Up

This is also the decade when you most probably are already going at work and your career has started taking off, and you are generating income for yourself. This is the year in your life when you can actually begin to put money down for retirement. You are very far from retirement; it is very, very long-term savings years, and small gains add up very quickly.

Key Points:

Maximize Your Pay Contributions:

You have worked long enough that most of your paycheck is readily available to invest 10-15% towards your retirement accounts.

Eliminate High Interest Debt:

Once you get rid of this, you will begin free flowing all that money into retirement savings.

Invest Aggressively:

The big block of time on your side allows you to invest far more aggressively than most other people in the market for greater returns over time.

3. Age 40: Getting Back on Track with Retirement Savings and Diversification

You will refocus towards retirement planning when you become 40. If you had a saving backlog, you are still on schedule, though retirement should be the first priority, and it's also a good time to audit your investment and spread out your investments so as to avoid risks that come with market fluctuations.

Key Points:

Catch-Up Contributions:

he IRS states that you can contribute even more to recently formed retirement accounts if you are 50 years of age or older.

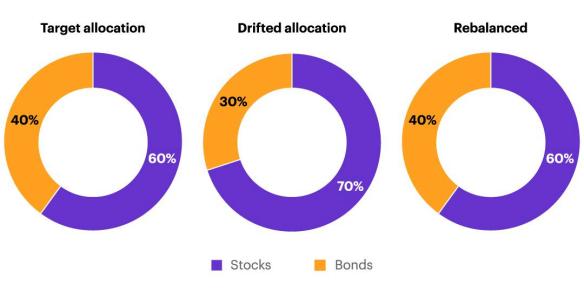

Rebalance the investment portfolio:

Rebalance the investment portfolio as it is important for growth to start taking place. An investment in a bond or any more conservative asset can set out to balance the investment portfolio

Save bonuses, inheritance, tax refunds:

These have the potential to significantly increase your retirement savings.

4. Retirement planning and savings at age 50 Retirement is knocking at the door:

During this age, it is the time to orient towards savings maximization and retirement preparation. This could be made possible through debt pay-off as well as an

increase in the rate of savings.

Key Points:

Make the most of your retirement account savings:

Make the most possible contribution to your retirement accounts. You are able to make multiple monthly contributions as well as extra contributions to traditional

IRAs and 401(k) s.

Pay off Large obligations:

Before you retire, make an effort to pay off your home loan and any other significant debt.

Calculate What You Want from Retirement:

Depending on the estimates that you may have of the funds needed in retirement, you may adjust the savings according to the estimations.

5. At Age 60+: Pre-Retirement Withdrawal Planning

It turns its attention toward retirement nest-egg protection and toward withdrawal planning when you start to enter or pass the age of 60s.

Key Points:

Delay the Receipt of Social Security:

If you can afford it, begin receiving Social Security at age 70 when that locks in the highest monthly benefit.

Plan a withdrawal strategy:

You can make a plan of how you will withdraw the money knowing tax implications and RMDs.

Identify a financial advisor:

This is the step where professional advice will be very useful in applying the subtleties of retirement income and withdrawal strategies.

Conclusion:

It's important to plan your retirement funds at every stage of life. Of course, the

most important thing is to start when you are as young as possible and contribute more as you grow older and change investment strategy over time. Combining all this-three employer-sponsored plans, catch-up contributions, and compound

interest-will result in a much more comfortable and secure retirement.

Remember, though, if you're comfortable doing it, and just take the first step, then all will be alright. Every little save today brings someone closer to financial freedom tomorrow.