Warren Buffett, known as the Oracle of Omaha, is widely recognized as an example of successful investing. Although many people know him for value investing, exploring his methods uncovers detailed strategies that can significantly benefit wealthy individuals aiming to enhance their stock market investments. Below are three important but less famous rules drawn from Buffett’s investment approach, designed specifically for those with substantial financial capabilities.

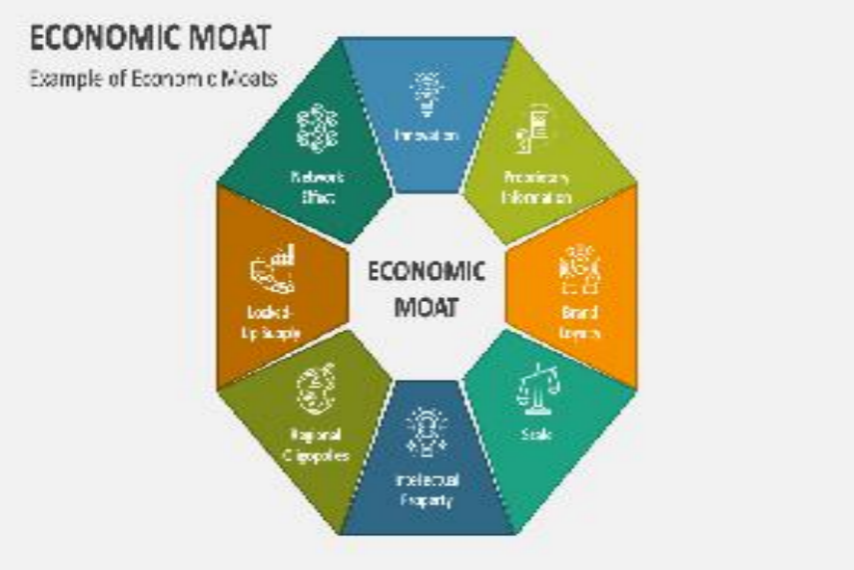

Rule 1: Focus on Economic Moats Beyond Brand Recognition

Buffett is widely recognized for highlighting the significance of companies with "economic moats," yet many people often think this term refers only to brand recognition. In truth, an economic moat includes a much wider array of competitive advantages. For investors focused on high value, it is essential to go beyond just consumer brands and find firms that possess distinct structural strengths.

Think about companies in biotechnology or technology that hold valuable intellectual property. Their patents, copyrights, and trade secrets can form strong barriers to competition, enabling these firms to keep their pricing power and profit margins stable over time. Likewise, businesses with strong network effects—such as well-known payment processors or social media sites—experience a powerful cycle of growth that is hard for rivals to interrupt. By putting money into companies with lasting economic moats, wealthy investors can shield their portfolios from market fluctuations and achieve consistent returns.

Rule 2: Embrace the "Margin of Safety" with a Modern Twist

The idea of a "margin of safety" lies at the heart of value investing, yet Buffett's method extends beyond merely purchasing stocks with low price-to-earnings ratios. In the current market, wealthy investors can utilize this concept by concentrating on businesses that generate a strong free cash flow. A company that continually produces significant free cash flow possesses the financial flexibility to endure economic challenges, explore growth prospects, and return profits to its shareholders.

Additionally, modern data analysis can improve how we evaluate the margin of safety. Rather than depending exclusively on past financial data, investors can leverage advanced algorithms to forecast a company's future cash flow, considering elements such as new market trends, changes in regulations, and technological advancements. This data-centric strategy offers a clearer understanding of a company’s true value, enabling investors to spot stocks with a greater margin of safety and minimize the chance of overpaying.

Rule 3: Think Long - Term with a Portfolio Construction Mindset

Buffett’s well-known saying, "Our favorite holding period is forever," highlights the significance of thinking long-term. Nevertheless, for wealthy individuals, this doesn’t entail keeping every stock forever without question. Rather, it means creating an investment portfolio that reflects a long-term outlook.

Key to value investing is diversification. Wealthy investors ought to develop a portfolio that encompasses stocks across various sectors, industries, and regions, all while following the principles of economic moats and maintaining a margin of safety. In addition, regularly rebalancing the portfolio is crucial; this is not intended to pursue fleeting market trends but to ensure ongoing alignment with long-term investment objectives. By embracing a comprehensive strategy for portfolio development and practicing patience, investors can withstand market ups and downs, leading to growth through compounding over time.

In stock value investing, Buffett's insights provide valuable guidance that, when applied to today's market conditions, can give wealthy individuals a distinct advantage. By emphasizing economic moats, strengthening the margin of safety through data analysis, and implementing a thoughtful long-term strategy for portfolio creation, investors can effectively navigate the complexities of the stock market and cultivate a strong investment portfolio that builds wealth.