For those with significant financial resources, determining if insurance is a good investment involves more than just protecting against risks. Whole life insurance, critical illness coverage, and annuity plans provide distinctive financial options that complement advanced wealth management approaches. It’s important to explore the rarely discussed features of these insurance types to grasp their real worth.

Whole Life Insurance: Beyond Death Benefits

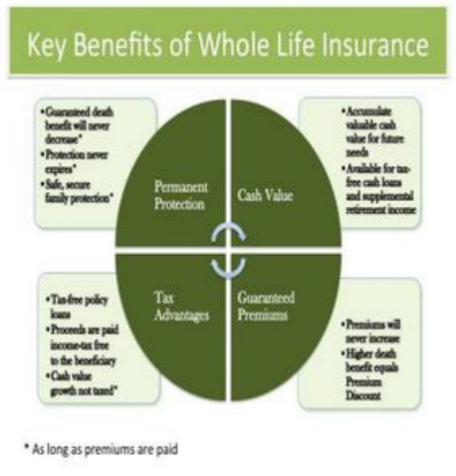

Whole life insurance is frequently overlooked as just a basic death benefit, yet it functions as an effective wealth management tool for affluent individuals. A feature that is not well known is its capacity to accumulate cash value gradually. This cash value can act as collateral for loans, allowing access to funds without needing to liquidate assets during financial crises or when investing.

Additionally, whole life insurance can be integrated into a private placement life insurance (PPLI) plan. With PPLI, wealthy investors can maintain a varied range of alternative investments, including hedge funds, private equity, and real estate, all within the insurance framework. This arrangement not only offers tax-deferred growth but also facilitates transferring wealth to heirs in a more tax-efficient and secure way, often avoiding probate altogether.

Critical Illness Insurance: A Gateway to Premium Healthcare

Critical illness insurance provides more than just a one-time payout when someone is diagnosed. For wealthy individuals, it serves as a gateway to premium healthcare services. Some premium critical illness plans include extra perks like worldwide medical concierge services. These services can help organize meetings with famous specialists, speed up access to new treatments, and even arrange for housing during long medical visits abroad.

Moreover, certain policies feature rehabilitation advantages designed for high-earning patients. This may involve customized physiotherapy at luxury wellness facilities, dietary advice from top nutritionists, and mental health assistance from distinguished therapists. By addressing these often-neglected areas of recovery care, critical illness insurance allows policyholders to concentrate on healing without worrying about money or logistical concerns.

Annuity Insurance: Integrating with Family Office Strategies

Annuity insurance serves not only as a source of retirement income; it can also be essential in the long-term wealth management strategy of a family office. Wealthy families often utilize annuities to establish a consistent income that sustains their way of life for future generations. These specially designed annuities can be tailored to reflect the family's priorities, such as supporting education for their heirs or engaging in charitable activities.

When combined with a family office, annuities contribute to managing financial risks. They provide a reliable income foundation that helps balance the fluctuations seen in other assets within the family's investment mix, which may include stocks and private equity. Moreover, certain annuity options come with long-term care benefits, an important feature for high-earners wishing to secure quality care in old age while protecting their wealth.

In summary, for those with substantial financial means, insurance products like whole life insurance, critical illness coverage, and annuities bring extensive advantages beyond their primary purposes. By recognizing these distinctive aspects and incorporating them into well-rounded wealth management plans, affluent individuals can safeguard their assets, improve their financial adaptability, and ensure a secure future for their families. The choice to pursue these insurance options is not solely about mitigating risks; it is about making thoughtful financial decisions that correspond with their long-term objectives and lifestyle goals.