For high - spending individuals, real estate isn't just a symbol of wealth—it can be a powerful engine for generating passive income. Beyond traditional rental strategies, there are innovative and sophisticated approaches that can turn properties into lucrative income streams with minimal active involvement.

Luxury Short - Term Rental Hubs

Rather than long - term leases, transform high - end properties into luxury short - term rentals. Platforms like Airbnb for luxury listings or exclusive vacation rental networks cater to affluent travelers seeking premium experiences. Furnish your property with designer furniture, state - of - the - art technology, and high - end amenities. Offer concierge services, private chefs, or spa treatments on - site. During peak seasons or major local events, these luxury rentals can command premium rates, often exceeding what traditional long - term leases would yield. Leverage professional property management companies to handle guest check - ins, maintenance, and cleaning, ensuring a truly passive income model.

Co - Living Spaces for the Elite

Create co - living spaces targeted at high - income young professionals or digital nomads. Design the property with shared common areas like gourmet kitchens, rooftop lounges, and high - tech meeting rooms, while providing private, well - appointed bedrooms. Incorporate exclusive perks such as fitness centers with personal trainers, co - working spaces with high - speed internet, and regular networking events. Charge a premium rent that includes all utilities, services, and access to these amenities. By focusing on a niche, high - value demographic, you can maximize occupancy rates and rental income while minimizing the hassle of individual tenant management.

Real Estate - Based Investment Syndications

High - net - worth individuals can participate in real estate investment syndications. Pool funds with other investors to acquire large - scale commercial properties, such as luxury hotels, high - end shopping malls, or upscale office buildings. As a passive investor within the syndicate, you gain from the rental income produced by the property, along with the chance for capital growth. Usually, experienced real estate professionals oversee syndications, taking care of tasks like buying, managing, and promoting the property. This permits you to spread out your real estate investments across various types of properties and places, without needing to manage them directly.

Property - Related Ancillary Businesses

Develop ancillary businesses around your real estate assets. For example, if you own a large estate, start a vineyard or a farm - to - table restaurant on the property. These companies have the ability to draw in customers, create extra revenue, and boost the total worth of the property.Another option is to offer property - based experiences, such as wine - tasting tours, cooking classes, or art workshops. By leveraging the unique features of your property, you create multiple revenue streams that require minimal additional investment once established, and can be managed by hired staff, ensuring passive income.

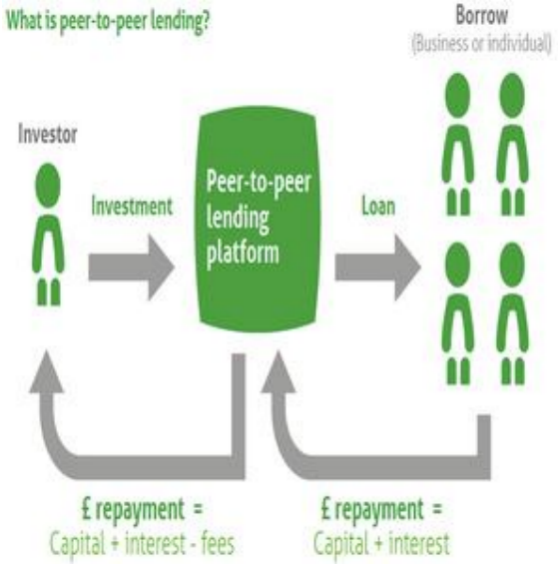

Real Estate - Backed Peer - to - Peer Lending

Instead of directly owning and managing properties, engage in real - estate - backed peer - to - peer lending. Investors and borrowers seeking funds for real estate projects, like property upgrades, purchases, or construction, are brought together by platforms. By lending money, you can earn interest. Usually, these loans are backed by real estate assets, which lowers the chance of someone not repaying. With proper due diligence on the borrowers and projects, you can build a diversified portfolio of real - estate loans that generate consistent passive income over time, without the headaches of property management.

In conclusion, high - spending individuals have a plethora of creative ways to generate passive income from real estate. By thinking beyond conventional methods and exploring these unique strategies, you can unlock the full income - generating potential of your properties and enjoy a steady stream of wealth with minimal active effort.