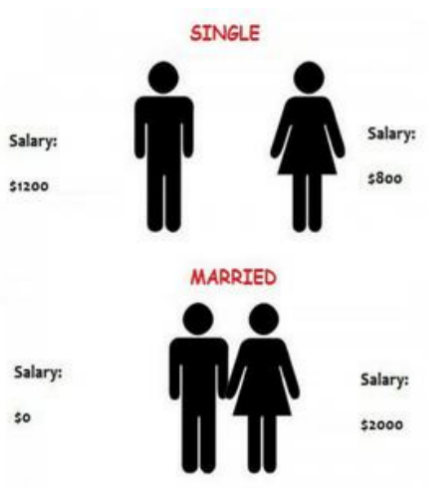

In the world of wealth management, the financial approaches of single people and married couples differ in interesting ways. For those with significant wealth, recognizing these differences isn't merely theoretical—it provides vital knowledge for enhancing investments, reducing risks, and reaching long-term financial objectives. Let’s examine how being single or married influences financial perspectives.

The Freedom and Flexibility of Single Finances

Individuals who are single frequently experience unmatched financial independence. They do not have to align their spending or financial plans with anyone else, which allows them to customize their methods according to their own values. This level of autonomy makes it possible for them to take bolder investment risks. For example, a number of single people are inclined to invest a large share of their finances in ventures that carry high risks but also the possibility of substantial returns, such as venture capital or stocks in growing markets. Since they do not have to share financial obligations, they can embrace more market fluctuations to seek better profits.

In addition, single individuals usually possess greater flexibility regarding lifestyle decisions that influence their finances. They can move for job prospects without having to think about a partner's needs, rent luxurious apartments in desirable areas, or treat themselves to extravagant experiences whenever they wish. Their financial planning often centers on personal ambitions, such as traveling alone, pursuing further studies, or establishing a personal brand, instead of family-oriented goals.

The Complexities of Married Financial Partnerships

Marriage changes how couples approach financial planning, making it a joint effort. Partners need to synchronize their spending habits for the near future and set their long-term financial objectives, often leading to necessary compromises. The idea of risk tolerance merges together; if one person prefers safety while the other likes taking chances, they must carefully discuss their investment choices. For instance, rather than only putting money into risky stocks, a married couple may decide to create a balanced investment portfolio, combining riskier growth assets with safer options like bonds or real estate.

Additionally, sharing financial duties becomes essential. Couples face a wider array of financial responsibilities, including mortgage payments, childcare costs, healthcare expenses, and plans for retirement. This might push them towards a more cautious strategy, focusing on building an emergency fund and ensuring the family's overall financial stability. Estate planning also grows complicated, requiring attention to shared assets, inheritance issues, and arrangements for children's guardianship.

Long-Term Planning: Solo vs. Shared Visions

In retirement and legacy planning, singles and married individuals view things quite differently. For those who are single, the focus is solely on their own retirement goals and expectations for lifestyle. They may opt to invest in unique assets like fine art or collectibles, which can increase in value over time and provide an interesting source of income during retirement. When it comes to legacy planning, these individuals often think about donating to charities or leaving their belongings to friends rather than family.

Conversely, married couples are focused on their future together. They strive to ensure that both partners can enjoy a comfortable retirement and that their assets transition smoothly to the next generation. This often means creating detailed estate plans, which include wills, trusts, and powers of attorney. Additionally, couples might look into shared retirement accounts and investment options that offer a steady income stream for both partners as they age.

Navigating Financial Challenges

Both single people and those who are married encounter different financial difficulties. Singles often deal with feelings of isolation in their financial choices, as they lack a partner to discuss options or alleviate financial pressure. Additionally, they must be more attentive to healthcare and long-term care planning because they don’t have a spouse to depend on during times of illness or disability.

On the other hand, married couples face the possibility of financial disagreements. Conflicts regarding spending habits, investment choices, or financial goals can put a strain on their relationship. To manage shared debts like mortgages or student loans, they need to communicate clearly and work together to steer clear of financial issues.

In summary, the financial perspectives of singles and married individuals are influenced by their specific situations, responsibilities, and ambitions. For those with considerable wealth, understanding these differences can lead to better wealth management techniques, whether they are single and enjoying financial independence or married while creating a unified financial future. By appreciating the subtleties of each situation, individuals can make wiser choices and reach higher levels of financial achievement.