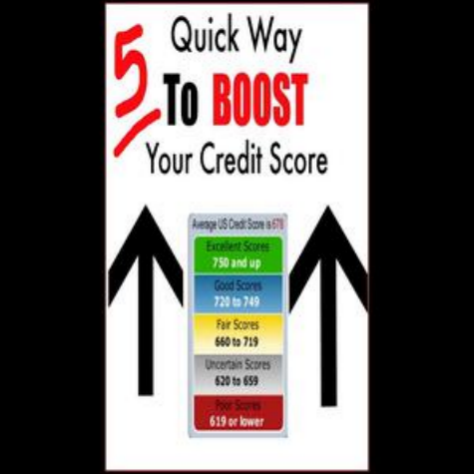

For high - spending individuals, credit scores are more than just numerical ratings; they are gateways to exclusive financial opportunities and hidden wealth. While common advice focuses on basic credit management, there are sophisticated strategies tailored to the affluent that can significantly enhance creditworthiness.

Leveraging Premium Credit Products Strategically

High - net - worth consumers have access to premium credit cards and loans with unique features that can positively impact their credit scores. Instead of relying solely on standard credit cards, consider high - end concierge - level cards. These cards often have high credit limits, which, when managed responsibly, can improve your credit utilization ratio—a key factor in credit scoring. For example, maintaining a low balance relative to a substantial credit limit on a premium card signals financial stability to credit bureaus.

Moreover, some private banking - offered loans come with flexible repayment terms. By choosing loans with early repayment options without penalties and making consistent, timely payments, you not only build a positive payment history but also demonstrate your ability to manage complex financial products. This can elevate your credit profile in the eyes of lenders.

Optimizing Credit in Niche Financial Scenarios

High - spending individuals often engage in niche financial activities that can influence credit scores. Real - estate investments, for instance, play a crucial role. When financing luxury properties, opt for lenders who report mortgage payments to credit bureaus. Consistent, on - time mortgage payments over the long term can be a powerful credit - building tool. Additionally, using home equity lines of credit (HELOCs) strategically can also boost credit scores. By keeping the utilization of HELOCs low and making regular payments, you showcase responsible borrowing behavior.

Another area is international financial transactions. High - net - worth individuals with global business interests or frequent international travel can benefit from using credit cards that report positive payment histories across multiple countries. This cross - border credit activity, when managed well, can add depth and strength to your credit profile.

Deep Dive into Credit Data Management

Beyond basic credit monitoring, high - spending individuals should engage in in - depth credit data management. Regularly review your credit report for inaccuracies, especially in relation to high - value transactions. A single error in reporting a large - sum credit card purchase or a high - end loan payment can significantly impact your score. Use professional credit repair services if necessary to ensure the accuracy of your credit data.

Furthermore, understand the nuances of credit scoring models. Different industries may use specialized credit scoring models. For example, when applying for private aircraft financing or high - limit business credit, lenders might use industry - specific scoring criteria. Tailor your credit - building strategies to align with these models by focusing on the factors that are most relevant in these high - value lending scenarios.

Building a Credit Ecosystem

High - net - worth individuals can create a credit ecosystem that reinforces their creditworthiness. This includes establishing relationships with multiple financial institutions. By having accounts with different banks, credit unions, and specialized lenders, you diversify your credit portfolio. Each positive interaction with these institutions, such as prompt loan repayments or responsible credit card usage, contributes to a stronger overall credit profile.

Additionally, consider co - signing loans or extending credit to trusted parties as a strategic move. When done carefully, co - signing can enhance your credit history if the primary borrower makes timely payments. It shows lenders that you are confident in your assessment of others' creditworthiness, which can reflect positively on your own creditworthiness.

In conclusion, for high - spending individuals, unlocking the hidden wealth within credit scores requires a strategic and sophisticated approach. By leveraging premium financial products, optimizing niche financial activities, managing credit data meticulously, and building a robust credit ecosystem, affluent consumers can elevate their creditworthiness and gain access to even greater financial opportunities.