In a world filled with constant messages about being financially successful, middle-class families with more money to spend frequently feel anxious as they try to grow their wealth. Yet, the road to financial success does not have to be filled with stress. By using different strategies that fit their financial conditions and mental health, these families can discover how to build lasting wealth without overwhelming pressure.

Rethinking the Consumption - Wealth Paradox

Individuals from the middle class who spend a lot often find themselves caught in the cycle of "lifestyle inflation." When their earnings increase, so do their expenses, which leaves little opportunity for substantial savings or investments. But what if we reconsidered this common belief? Instead of seeing consumption merely as a way to show off status, we could view it as a means to create wealth. For example, investing in experiences such as educational travel or quality professional courses can improve one’s skills. These experiences not only enhance life but may also increase future earning potential.

Another important idea is "conscious consumption." Middle-class families should aim to buy long-lasting, valuable items that keep their worth, like quality furniture or timeless art pieces. Such items may grow in value over time and serve as alternative investments instead of just ordinary purchases. By making thoughtful spending decisions, families can find a good balance between living well and accumulating wealth.

Diversifying Beyond Traditional Investments

Although stocks, bonds, and real estate are typical choices for investing, those in the middle class can look into other options that might lower risk and enhance their profits. A promising field is private equity focusing on small, local companies. By putting money into startups or family-run businesses in their community, investors not only have the chance to earn money but also help boost the local economy. This investment style offers a more active role, allowing investors to gain a better insight into their investments and feel more in control.

Collectibles also offer a unique investment path. Items like rare wines, vintage cars, and limited-edition watches can increase significantly in value over time. Middle-class collectors can use their interests and expertise in specific areas to create a valuable collection. However, it is vital to conduct thorough research and due diligence regarding collectible investments, treating them like important financial assets instead of mere hobbies.

The Power of Psychological Resilience in Finance

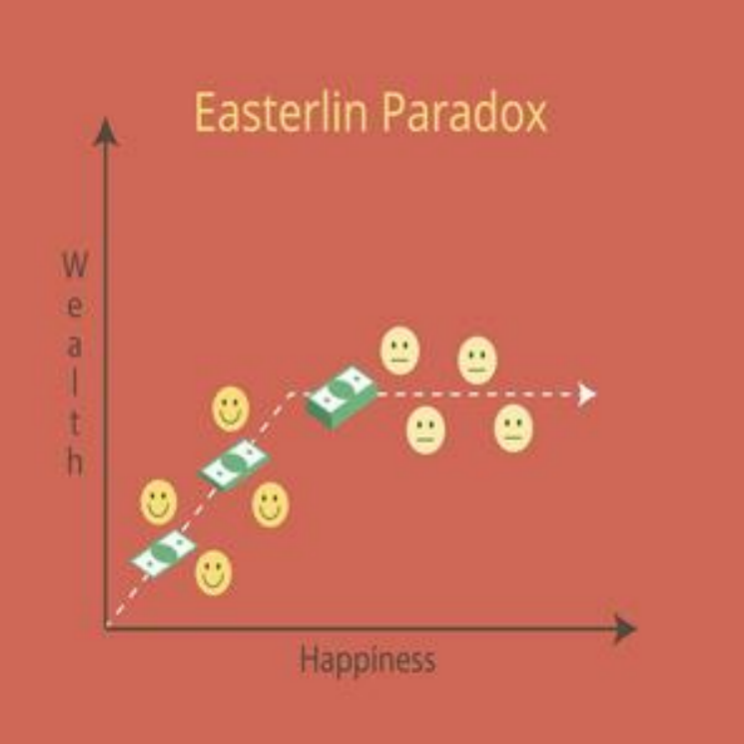

Often, anxiety arises from uncertainty in financial markets. Families in the middle class can strengthen their mental toughness by learning about behavioral finance. For instance, the “anchoring bias” might cause investors to make poor choices influenced by previous prices. By recognizing these mental shortcuts, families can make smarter investment decisions.

Building a financial “safety narrative” can also help lessen anxiety. Rather than fixating on market declines, it’s better to concentrate on long-term financial objectives and acknowledge the achievements you’ve made so far. Small triumphs, such as eliminating a large debt or achieving a savings goal, are worth celebrating. This optimistic perspective not only reduces worry but also promotes steady financial habits.

In summary, middle-class families with greater spending power possess the means and chances to grow their wealth without letting anxiety take over. By reassessing their spending patterns, seeking varied investment choices, and developing mental resilience, they can pave the way for a financially successful journey that is both fulfilling and stress-free.