In a world where financial success often equates to personal worth, money anxiety has become an insidious companion for many, especially those with high spending capabilities. While common signs like excessive saving or overspending are well - known, there are subtler symptoms lurking beneath the surface. Let’s uncover these hidden manifestations and see which ones might be silently affecting you.

The Paradox of Abundance Anxiety

For individuals with high spending power, the anxiety doesn't always stem from a lack of funds.On the contrary, it often stems from the pressure to sustain a particular way of life.The fear of losing the luxury and comfort one has grown accustomed to can be paralyzing. This is the paradox of abundance anxiety - even when you have more than enough, the constant worry about sustaining that level of affluence haunts you.

You may often catch yourself measuring your wealth against that of others in your social group.Seeing peers acquire new properties, luxury cars, or exclusive experiences can trigger a sense of inadequacy, despite your own financial stability. This perpetual comparison game creates a never - ending cycle of self - doubt and anxiety, eroding your peace of mind.

Decision - Paralysis in Financial Choices

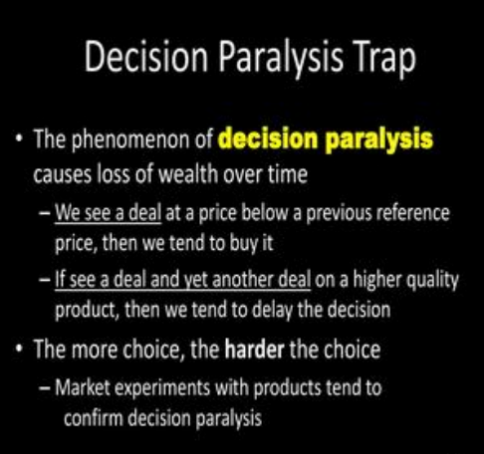

High - spending individuals often face a plethora of financial decisions, from investment opportunities to major purchases. Ironically, the abundance of choices can lead to decision - paralysis. The fear of making incorrect choices—whether it involves investing in a new business or purchasing a costly item—can trap you in a state of indecision.

This paralysis isn't just about the potential financial loss. It's also about the psychological burden of knowing that each decision reflects on your financial acumen and status. You may agonize over the details, second - guess your instincts, and ultimately avoid making any decision at all, missing out on opportunities in the process.

Emotional Attachment to Material Possessions

While possessions are meant to enhance our lives, for some, they become a source of anxiety. High - spending individuals often develop an emotional attachment to their luxury items, seeing them as symbols of their success and identity. This attachment can turn into a fear of loss. The thought of damage, theft, or simply the depreciation of these valuable possessions can cause significant distress.

Moreover, the pressure to constantly upgrade and acquire the latest and greatest items can be overwhelming. Keeping up with the ever - changing trends in the luxury market becomes a never - ending race, fueled by the fear of being left behind or appearing less successful.

The Burden of Wealth Management

Managing substantial wealth comes with its own set of anxieties. The intricacy of financial portfolios, tax rules, and estate planning can be quite overwhelming. Even with professional help, the responsibility of ensuring that your wealth is protected, grows, and is passed on correctly weighs heavily.

There's also the fear of unforeseen financial crises. Despite having significant resources, the knowledge that economic downturns, legal issues, or personal emergencies can quickly derail your financial stability can lead to a constant state of unease.

In conclusion, money anxiety in high - spending individuals is a complex issue with many hidden dimensions. Identifying these symptoms is the initial move in tackling them.Whether it’s breaking free from the comparison trap, learning to make confident financial decisions, or reevaluating your relationship with material possessions, taking control of your money anxiety is essential for achieving true financial well - being and peace of mind.