The combination of AI and finance is transforming industries around the world, creating new opportunities, particularly for wealthy investors looking for growth potential. Below are sectors that are likely to see considerable benefits.

Wealth Management 2.0

AI is advancing wealth management beyond just simple robo-advisors for affluent clients. Sophisticated AI tools not only examine financial data but also consider personal aspirations, changes in risk tolerance, and even public sentiment gathered from social media and market reports. For instance, AI can forecast how adjustments in inheritance plans or retirement timelines may affect a client's portfolio, creating personalized strategies that conventional advisors often cannot provide. This level of personalization draws in wealthy clients, enhancing the appeal of firms that implement AI-enhanced wealth management strategies.

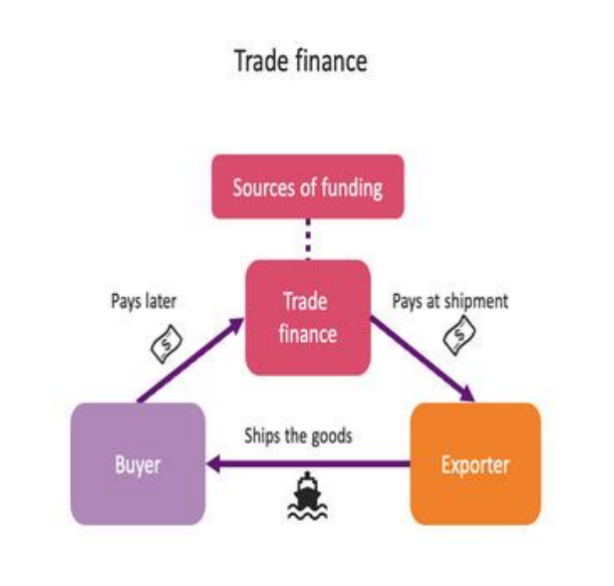

Trade Finance and Supply Chains

AI enhances trade finance, a field that has long struggled with document delays. Intelligent algorithms automate the process of document checks, monitor cargo in real time, and evaluate the credit status of small to mid-sized suppliers within international supply chains. Companies involved in cross-border trade, such as luxury items or industrial machinery, can see transaction times reduced by 50%, which lowers fees and lessens the risk of defaults. Wealthy investors can capitalize on this trend by funding fintech companies that provide AI-based trade finance solutions, as global corporate demand continues to rise.

Microfinance and Financial Inclusion

Often unnoticed, AI-enabled microfinance serves both financial providers and underrepresented communities, while also benefiting sectors that promote financial inclusion. AI analyzes creditworthiness for individuals lacking conventional credit scores by utilizing information such as mobile payment patterns and utility bills. This increases access to microloans, positively impacting areas like small-scale farming or local shops in developing regions. Investors can find steady returns in microfinance firms using AI, which are tapping into a market worth over $300 billion, showing less connection to global stock movements.

Cybersecurity for Financial Institutions

As the finance sector becomes increasingly digital, AI-driven cybersecurity has become vital. Rather than relying on standard firewalls, AI can identify suspicious activities—like a wealthy client making unexpected overseas transactions or unusual access to a bank’s internal data—before breaches happen. There is a strong demand for cybersecurity companies that focus on financial AI, as banks, cryptocurrency platforms, and wealth management firms aim to safeguard client assets. Putting money into these organizations aligns with the rising importance of strong digital security in finance.

Regulatory Technology (RegTech)

With financial regulations becoming more intricate, AI offers a way to streamline compliance. RegTech companies employ AI to oversee transactions in real time for issues like money laundering or tax fraud, adjusting automatically to new rules across different regions. This is essential for areas such as private banking and hedge funds, which are under intense regulatory oversight. AI-enhanced RegTech can lower compliance costs by 30% for financial organizations, promoting wider acceptance and opening up investment opportunities for those interested in stable, regulation-driven industries.

In conclusion, the integration of AI and finance benefits a wide array of sectors beyond just banking. For high-spending investors, these areas present exciting growth opportunities worth investigating.