For individuals with significant wealth, decreases in mortgage rates present a vital decision: to pay off debts or to enhance assets. The solution resides not merely in the apparent rates but in ensuring choices correspond with enduring financial stability and objectives.

Assess Opportunity Cost Beyond Interest Rates

Reduced mortgage rates are not isolated occurrences. Consider what your funds for prepayment might generate through strategic investments—such as private equity or specialized real estate—that yield better returns than your loan interest. For instance, while a mortgage rate of 4% may seem manageable, it cannot compete with an 8% gain from a carefully selected venture portfolio.

For affluent investors, this assessment transcends simple percentages by incorporating prolonged portfolio appreciation. Paying off a mortgage ahead of schedule secures a set “savings” based on the interest rate; however, it also forfeits the compounding advantages associated with higher-yielding assets. Even a seemingly minor difference of 2-3% between mortgage rates and investment returns can accumulate significantly over ten years, particularly when reinvesting dividends or distributions. Astute investors view prepaying as capital that can be utilized, rather than as dormant funds, contemplating guaranteed interest savings against the potential gains from focused investments.

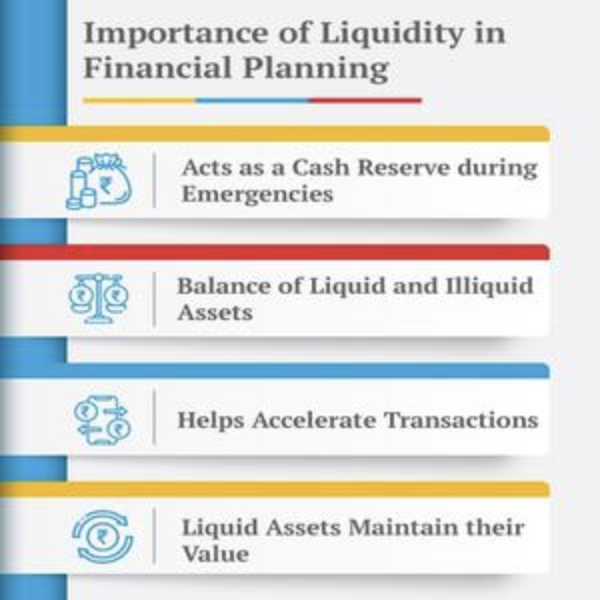

Emphasize Liquidity as a Financial Safety Net

Making prepayments restricts funds within illiquid real estate. Wealthy investors require capital that can be easily accessed for chances (such as unexpected asset acquisitions) or urgent needs. Instead, maintain prepayment reserves in short-term, high-yield options to achieve a balance between safety and availability.

This liquidity reserve serves both as a safety net and as a prompt for new opportunities. High-yield savings accounts, short-term Treasury bills, or accessible alternative funds empower investors to capitalize on time-sensitive opportunities—like a distressed luxury property or a rare collectible—without the hassle of sourcing funds. In urgent situations, this strategy prevents the necessity of forced sales of long-term assets at unfavorable prices. For high earners, liquidity represents not only availability; it also signifies the ability to manage wealth effectively, ensuring they never miss critical opportunities or incur unwarranted losses because of frozen funds.

Utilize Mortgage Interest for Tax Efficiency

Mortgage interest frequently provides opportunities for tax deductions, particularly for affluent individuals. Paying off the mortgage early removes this advantage. Instead, redirect your resources toward tax-favored investments—like donor-advised funds or retirement savings accounts—to enhance after-tax gains.

Correspond with Asset Allocation Objectives

The layout of your investment portfolio should inform your decision. If you are too heavily weighted in real estate, prepayment helps decrease concentration risk. Conversely, if your portfolio lacks growth-oriented assets, utilizing those funds for investment can diversify your assets, shielding you from market fluctuations.

Not every mortgage is alike. Review any prepayment penalties or variables in your loan terms. A fixed-rate mortgage with no associated penalties allows for greater flexibility, whereas a variable-rate option may justify partial prepaying to secure savings.

Consider Your Stage of Life and Legacy Considerations

Younger investors may focus on growth, whereas those approaching retirement may prefer financial independence. For individuals with estates in mind, investing could create wealth for future generations, while prepaying may ease estate planning by lowering liabilities.

The choice ultimately depends on your individual financial circumstances. It is less about selecting between debt elimination and asset growth but rather about leveraging reduced rates to enhance your comprehensive wealth strategy.