For wealthy individuals, the concept of “becoming wealthy” transcends mere financial accumulation—it is based on a collection of thought processes that transform typical monetary choices into remarkable lasting outcomes. The notion that affluence arises from chance or sudden success diminishes when one considers the perspective of the affluent: emphasizing structured approaches instead of quick fixes, prioritizing substance over superficiality, and valuing endurance over immediate rewards. Embracing these perspectives doesn’t necessitate a sudden influx of cash; it calls for a re-evaluation of your perception and utilization of finances.

Assets Over Liabilities: The Foundation Shift

The typical mindset pursues burdens that are falsely presented as valuable—luxury vehicles that lose value, lavish homes that entail significant maintenance, or high-end items that depreciate. In contrast, the mentality of wealthy individuals focuses on acquiring assets that generate income: rental properties overseen by others, stocks that provide dividends, or investments in businesses that run efficiently without constant involvement. Each expenditure raises a consideration: Will this generate income for me or drain my finances in the long run? This transformation makes spending akin to investing.

Time Leverage Over Time Trading

Even individuals with high incomes frequently exchange their time for financial compensation, which restricts their earning potential to the hours they work. The mindset of the affluent maximizes time by establishing income sources that extend beyond personal involvement. A consultant may convert their expertise into an online educational program; an investor may support entrepreneurs who implement concepts. This approach is not about reducing work but rather enhancing efficiency, allowing wealth and influence to expand while resting. Time becomes an amplifier rather than a limitation.

Abundance Over Scarcity

Thinking rooted in scarcity concentrates on economizing or accumulating resources, driven by the anxiety that there may never be sufficient. The rich mindset functions from a perspective of abundance: it recognizes possibilities to generate more wealth rather than merely safeguarding what is already accumulated. This involves investing in learning to enhance capabilities, collaborating with others to tap into new markets, or contributing to initiatives that foster social wealth. Abundance acknowledges risk but welcomes calculated risks that yield higher rewards.

The clamor of market fluctuations and quick-money schemes can entice even wealthy individuals. However, the mindset of the affluent disregards the distractions, prioritizing goals set for a decade rather than immediate profits. It understands that wealth accumulates gradually—through compounded returns, steady growth of assets, or brand development over many years. A $1 million investment yielding an 8% return doubles in approximately nine years; patience transforms consistent, small actions into significant wealth.

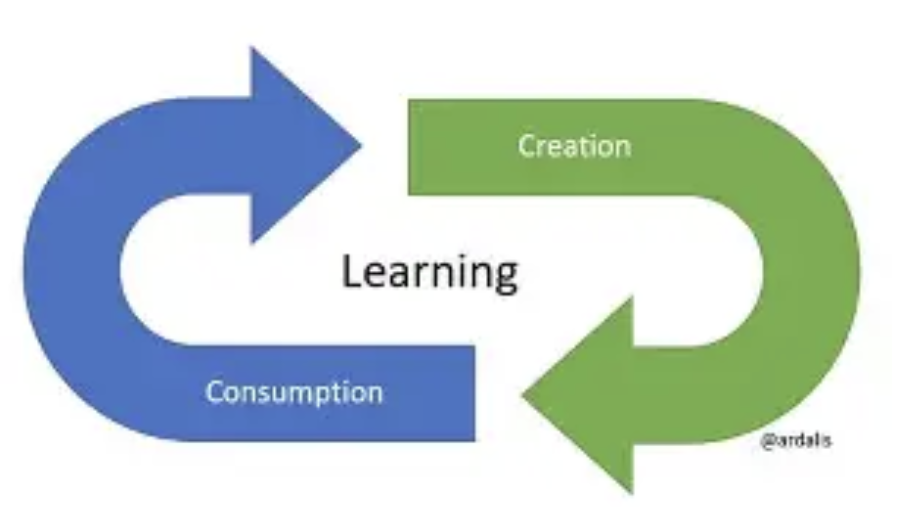

Value Creation Over Consumption

Mindsets centered on consumption assess success based on purchases; the wealthy mindset evaluates success by the value generated. This may involve innovating a solution-oriented product, guiding others to form cohesive teams, or enhancing a community to elevate property values. The more value created for others, the greater the wealth that returns to you—through profits, collaborations, or new opportunities.

Mindset as the Ultimate Asset

Wealth is not merely a figure in a bank account—it represents a mindset that influences every choice made. Embracing the attitude of the wealthy does not necessitate inheriting wealth or winning the lottery; rather it entails prioritizing structured approaches over quick fixes, abundance instead of scarcity, and value as opposed to superficiality. For individuals with considerable wealth, this outlook transcends the pursuit of greater riches—it focuses on cultivating enduring wealth that evolves and imparts significance long after the initial gathering.