For people with a consistent of considerable expenditors, continuance of the financial individuation often then suffice alternate of the simple accumulation of the income. In fact, the true financing independence is complicated - cognitive height - a deep processing - a deep transformation and understanding that can succeed in their financial landscape.

Beyond the Numbers: The Cognitive Shift

The high income often focusing its wealth for investment, business companies or career advancement. However, travel to financial independence requires substantial change from cognitive perspective. It's not just about knowing how much you gain, but as perceive and manage the money.

consider the concept of "mental accounting". Instead of in terms of money as monolithic entity, individuals with elevated recognition were shared their resources according to purpose and potential. They understand the difference between wealth - generate active active and depreciate and make strategic decisions accordingly. For example, instead of buying the last luxury vehicle displays, that the value quickly loses the value, they can invest in real estate with high-level draft. This cognitive clarity allows you to share the most effective funds, which invest in innovative innovatories, diversification of their Portfolio, or followed the financial objects of long -tm.

more, those who published financial recognition recognizes the power of interest not only as a math formula, but as a state of mind. Prisoner first and consistent investments, taking exponential growth of their money over time. This reflection approach before contrasting with the tendency usually focus on the short bin, emphasize the cognitive change in Perform financial independence.

The Role of Emotional Intelligence in Finance

Financial independence is not only a matter of rational decision; Emotional intelligence also returns a crucial role. The high people often make the unique financial pressure and financial temptations. Those who have a higher level of cognitive consciousness of handling their emotions, avoid impulsive purchases and make more financial choices.for example, include psychological prejudices that may be dark by joy, as avoiding loss or training in Effect During the market lladown, instead of panicity and selling lost investments, ancient objectively and can also see as an opportunity to buy assets submitted. I usually face with pressure by colleagues to make luxury purchases, pushing financial goal for the status of the short -ter's suit. This emotional offability, have appeared with a financial sense, is a key element of financial independence.

emotional intelligence also comes in game when it comes to financial obstacles. Individuals old - net individuals with lift vision failures such as learning experiences. They do not leave a failed investment or business company prevents their financial plans, but rather use the lessons learned to make better decisions in the future.

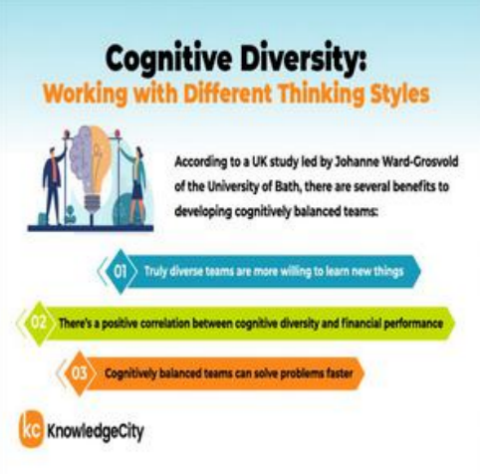

Cognitive Diversity and Financial Innovation

In the rapid developmental landscape, cognuctive diversity is a powerful powerful asset. The senior not individuals - which adopted a wide range of knowledge and perspective are more act to identify the possibilities of trends. This may mean to explore alternative investments such as Cryptocrenrenchy, Capital of Entrepreneur or Sustainable Finance.eg, understanding his / her technology initials can open doors for opportunity in digital regipurs active space. In the same, having a favor of environment and government (enjo) can drive in investments in companies not only in autorocution, they also contribute to more sustainable future. Also, cognitive flexibility allows adaptation to change economic conditions. Instead of displaying in traditional financial patterns, those with high strategy, those with a lot with challenge the item quo, look down calated risks. This wish of Innovation and adaptation is essential to maintain financial independence in a whole world withthey are also imposed and different communities of investors, entrepreneurs and thinkers, express new ideas and prospects. This crossing policy often leads to the discovery of single invoice opportunities and innovative strategies and distinguishes from the crowd.

Lifelong Learning as a Catalyst

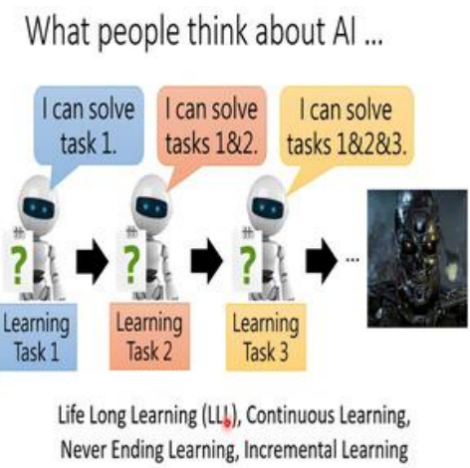

The achievement and maintenance of financial independence requires a commitment to learn throughout life. High income that you priorit the cognitive growth congested in financial markets, economic trends and new investment vehicles. Assist to the seminators, read the postings and engage with the financial experts, constantly expanding their knowledge basis.

in like the Official teaching Vidic, they also seek true experiments in the world. This may include mentoring Programs where they teach experienced investors, or they participate in departure incubators to have hands - in experience in the entire world of entrepreneurship. I understand that knowledge is not static and what has worked in the past may not be important in the future. To be updated with the Latest financing financing and areas, they can make more informed decisions, anticipate trends and regulate their financial strategies.

This trail of knowledge Improve their financial decision not only - recivation ability but also expanding their horizons. This allows you to see the general situation, understand the interstemeze in advice economic factors, and make funding financial plainment available. In essence, lifelong learning is the checnet that stimulate raised growth and, lately, in financial independence.

in conclusion, for those with consistable expense power, financial endearance is a journey with many aspects that go Beyond the wealth of wealth. It's a continuous process of cognitive growth, emotucted exploration and intellectual exploration. Increasing their financial acknowledgment, altered individuals may not only obtain financial independent, but also a Friday even a further further raises and more complete risk.