Individuals with significant wealth looking to expand their financial investments and protect their assets should carefully examine the value of investing in international insurance. By comparing insurance options available in the U.S. and China, one can discover distinct benefits and factors to consider, aiding in smart decision-making.

Product Diversity and Specialized Coverage

The US insurance industry is well-known for its creative and varied range of products. Insurers frequently offer specialized plans for wealthy clients, such as private client insurance that combines coverage for homes, liability, and personal collections. These plans might cover valuable items like art, jewelry, and luxury yachts, offering additional benefits like global coverage and quick claim processing.

On the other hand, Chinese insurance firms are evolving quickly, focusing more on life and health products to cater to a wealthier population. Some companies in China provide detailed critical illness insurance that offers large payouts when specific diseases are diagnosed, along with wellness perks like access to premium medical facilities and health management. Wealthy individuals in China can also discover unique annuity options that provide stable long-term returns, reflecting the nation’s economic growth.

Regulatory and Legal Frameworks

The insurance landscape in both the US and China is heavily influenced by their respective regulatory frameworks, which also shapes consumer protection. In the US, regulations differ across states, resulting in a complex yet adaptable system. This flexibility enables insurers to customize products to meet diverse local demands. Policyholders can take advantage of a strong legal framework for handling disputes, though the variation in state laws can make it somewhat difficult to manage.

In contrast, China's insurance regulatory system, managed by the China Banking and Insurance Regulatory Commission (CBIRC), focuses on stability and safeguarding consumers. Insurers face strict capital requirements, ensuring their financial health, while oversight of product creation helps uphold market fairness. Nonetheless, the regulatory environment is changing, necessitating that international investors keep informed about policy updates that could impact their insurance investments.

Tax Implications and Financial Planning

Insurance policies in the United States provide tax benefits that attract wealthy individuals. For instance, cash-value life insurance allows the cash value to grow without being taxed, and loans taken against this cash value are usually not subject to taxes. Furthermore, the payouts from life insurance are often exempt from income tax, making it a useful asset for estate planning.

In China, the tax advantages related to insurance differ, yet they hold great importance. Premiums for specific health and pension insurance plans might qualify for tax deductions, promoting savings for future financial stability. As China continues to update its tax regulations, insurance products are expected to become increasingly important in managing wealth effectively with tax in mind.

Underwriting and Risk Assessment

In the United States, insurance companies frequently use advanced models for underwriting that take many different factors into account, like credit scores, personal lifestyles, and sometimes even genetic tests for life and health insurance. This thorough method helps create more tailored assessments of risk and premium costs, benefiting those individuals who have better risk profiles.Conversely, insurers in China typically focus on more conventional factors, including age, medical backgrounds, and job types. Nevertheless, with the increase in using data analytics and artificial intelligence, the methods for underwriting in China are evolving, leading to more precise risk evaluations and better pricing options.

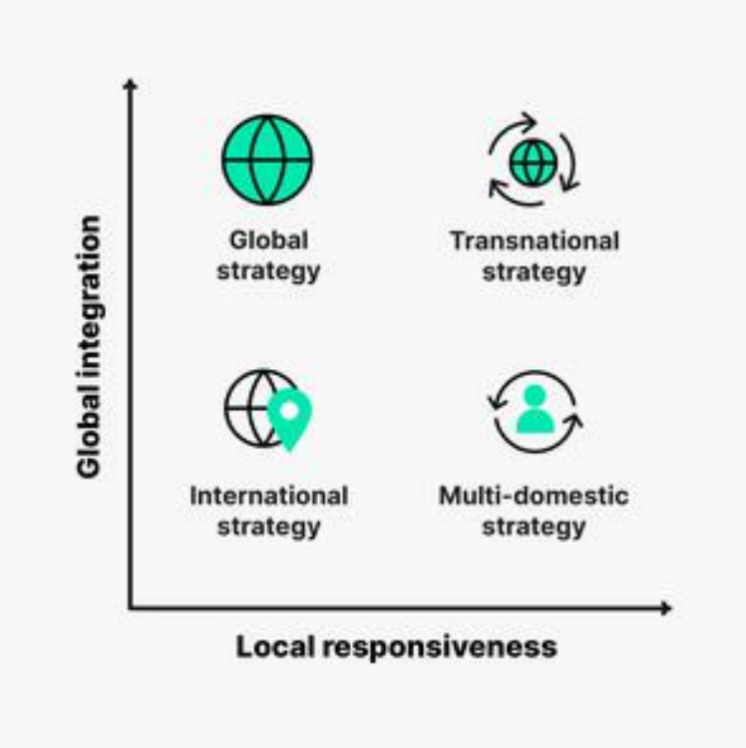

Global Reach and Multinational Considerations

For people who lead international lives or have business ventures abroad, insurance providers in the US might have an advantage due to their global presence. Numerous significant US insurance companies maintain broad networks and can offer policies that cover various countries, which is particularly useful for expats and internationally operating firms.

Simultaneously, Chinese insurance firms are growing their international reach, especially in areas linked to the Belt and Road Initiative. Wealthy individuals connected to these regions might discover that Chinese insurers are well-suited to provide extensive coverage tailored to their needs when dealing with cross-border issues.

Ultimately, the decision to purchase overseas insurance depends on personal situations, financial objectives, and how much risk one is willing to take. A careful evaluation of both US and Chinese insurance options indicates that each market possesses distinct advantages. Affluent individuals can take advantage of the varied products, regulatory aspects, tax incentives, and global services from both to create a well-rounded insurance portfolio that fulfills their unique requirements and protects their assets.