Many believe that a “cash flow machine” necessitates significant capital or sophisticated financial abilities, but for those who spend freely, it focuses on aligning assets strategically and utilizing available resources effectively. The intent is not to achieve quick riches but to establish a consistent, passive revenue that supports living expenses, allowing you to escape the necessity of exchanging your time for money, even with your prevailing spending patterns.

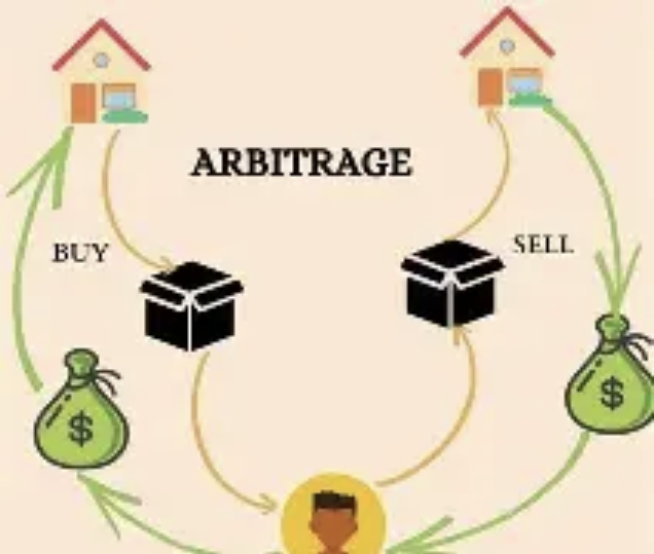

Start with "Value Arbitrage" Assets

Consider alternatives to standard stocks; concentrate on assets where you can enhance value. For instance, acquire luxury rental properties that are priced low in developing tourist areas, and then renovate these to achieve higher rental prices. Alternatively, invest in niche enterprises (such as art consultancy or specialty fitness) where your knowledge can increase earnings—transforming a passive investment into one that generates greater cash flow.

Leverage Existing Networks for Deals

Individuals who spend significantly frequently have strong connections—tap into them for unique prospects. Your private banker might introduce you to pre-IPO dividend shares, or an entrepreneurial associate could provide an opportunity to invest in a cash-positive startup. Participate in industry gatherings to network with property developers who might have off-market rental listings; these opportunities usually come with more favorable conditions and greater returns compared to public offerings.

Design "Tiered" Passive Income Streams

Refrain from depending solely on one income stream. Establish tiers: Tier 1 (consistent, low-effort) including dividend ETFs or peer-to-peer lending; Tier 2 (moderate effort) such as vacation rentals or licensed content (for example, online courses based on your expertise); Tier 3 (high-return, niche) such as luxury resale partnerships or exclusive membership organizations. This framework ensures a mix of stability and growth, allowing adaptation to market fluctuations.

Monetize "Invisible" Assets

You probably possess assets that you haven’t utilized. A collection of fine art or vintage timepieces can be lent to galleries for a recurring fee. Your knowledge in areas like technology or finance could be transformed into a subscription-based newsletter featuring premium advertising offers. Additionally, your social media presence (if it relates to luxury or lifestyle) can facilitate affiliate relationships with brands you already support—converting influence into cash flow.

Automate Reinvestment Loops

Establish systems to reinvest a portion of your cash flow automatically. For example, allocate 30% of rental income for acquiring additional properties, while 20% of dividend income could be used to fund a new niche enterprise. This compound effect expands your cash flow machine exponentially with minimal management. Utilize high-quality financial tools to monitor each income source, ensuring that reinvestments are in harmony with your comprehensive strategy.

Protect Cash Flow with Smart Hedging

Individuals with significant spending can’t risk interruptions to their cash flow. Safeguard against uncertainties: Apply insurance for rental properties, diversify investments across multiple sectors to mitigate sector downturns, and arrange long-term agreements for enterprises (such as a 5-year lease for your vacation rental). For unpredictable assets like cryptocurrencies or art, allocate only a minor portion of your investments—keeping the main cash flow secure.

Creating a cash flow machine as a high-spender centers on ingenuity rather than just funds. By utilizing your network, increasing the value of assets, and strategically organizing your income streams, you establish a system that supports your lifestyle while growing autonomously—transforming regular income into remarkable financial independence.