High-net-worth individuals no longer focus solely on the basic accumulation of wealth; their interests extend to areas beyond traditional returns. Their key considerations involve intangible benefits, enduring legacy, and tailored experiences that resonate with their specific lifestyles and core values. These implicit priorities influence their choices and distinguish the services they opt for.

For affluent clients, trust and customized care are vital foundations—they look for advisors and service professionals who comprehend their specific situations, uphold their confidentiality, and share their long-term objectives instead of advocating for one-size-fits-all strategies. They appreciate clarity in all communications, whether handling investments, organizing estates, or designing luxury experiences, and favor relationships that feel cooperative rather than merely commercial. More than financial returns, what holds genuine importance is the confidence that their assets are managed in a manner that respects their persona, safeguards their family, and makes a significant impact on the initiatives they value.

Privacy as an Essential Resource

For high-net-worth individuals, maintaining privacy transcends mere preference; it is an essential resource. In a time dominated by digital tracking and excessive sharing, they look for partners who diligently protect their personal, financial, and familial data through stringent measures. This goes further than just securing data; it encompasses discretion in all dealings, ensuring that their affairs stay confidential and devoid of unwanted attention or public visibility.

Transferring wealth is not only about conveying assets to subsequent generations. High-net-worth individuals are deeply invested in creating a legacy that embodies their principles, whether through charitable giving, family governance, or instilling a sense of accountability in their descendants. They seek counsel to align their financial resources with valued causes and establish a lasting influence that surpasses mere financial achievement.

Customized Expertise Over Uniform Solutions

High-net-worth individuals dismiss generic services. They require advisors and partners who take the initiative to understand their particular situations, objectives, and even unique quirks. This entails customized strategies that consider intricate portfolios, global assets, and personal interests, rather than standard advice that neglects their distinct requirements.

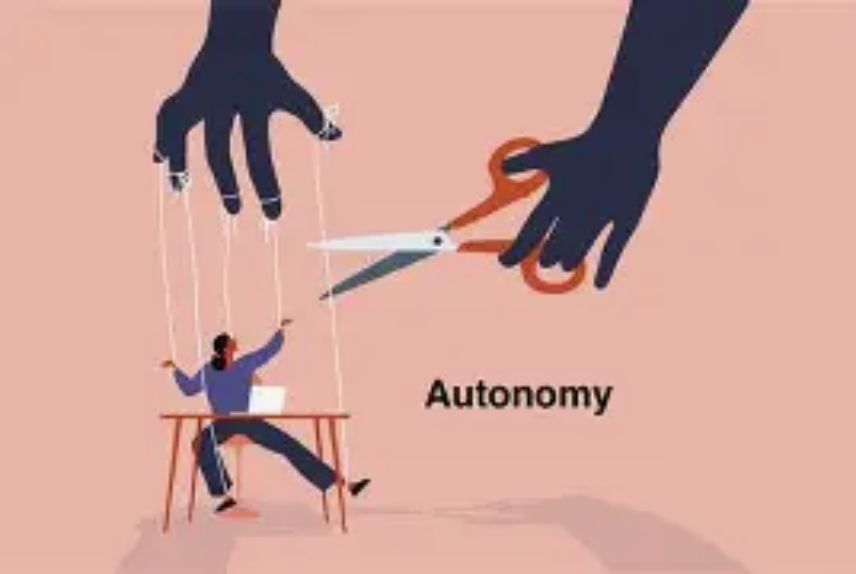

Autonomy in Life Decisions

With wealth comes the power to steer one's own path, and maintaining this autonomy is paramount for high-net-worth individuals. They are averse to feeling obligated to institutions or being confined by inflexible arrangements. Whether through adaptable investment options, tailored lifestyle services, or the ability to adjust strategies promptly, they cherish choices that allow them to dictate their own terms.

Genuine Connections Over Transactions

High-net-worth individuals yearn for authentic relationships with those they collaborate with. They grow weary of transactional exchanges and prefer partners who function as trusted allies rather than merely service providers. This entails advisors who prioritize listening, anticipate requirements, and display steadfast integrity—relationships rooted in mutual respect and long-term dedication.

Safeguarding Against the Unforeseen

Beyond basic insurance, high-net-worth individuals emphasize a comprehensive approach to risk management. This involves shielding against potential reputational harm, legal conflicts, geopolitical uncertainties, and even familial discord. They look for thorough strategies that protect their wealth, family, and reputation against unexpected occurrences that could jeopardize their hard-earned achievements.

Ultimately, the priorities of high-net-worth individuals are based on independence, meaningful purpose, and trust. They seek more than just financial oversight; they desire partners who recognize that genuine wealth lies in the ability to lead life according to their own wishes, establish a significant legacy, and safeguard what they hold dear. Understanding these intricate needs is crucial to attracting and keeping this discerning demographic.