Uncertainty has emerged as a consistent factor in international finance—geopolitical tensions, policy reversals, and technological changes can transform markets in an instant. For individuals with significant wealth, managing such fluctuations necessitates more than just simple diversification; it calls for innovative, adaptable tactics that convert unpredictability into a strategic advantage, rather than a potential risk.

A primary strategy involves creating a versatile portfolio that combines cautious investments (including inflation-adjusted bonds and basic commodities) with fast-growing, forward-looking industries such as clean energy and cutting-edge technology. Contrary to fixed, uniform strategies, this adaptable method enables investors to quickly adjust in reaction to new risks or opportunities, transforming market fluctuations from a danger into an opportunity to readjust and enhance returns.

Asymmetric Alternative Asset Allocation

In addition to conventional stocks and bonds, assets that do not correlate with the market and possess asymmetric risk-reward characteristics stand out during periods of unpredictability. Investments such as loans secured by art, private infrastructure agreements, and royalties from intellectual property provide reliable cash flow while remaining distinct from market volatility. Unlike typical alternative investments, these selections minimize downside risks while capturing unique upside opportunities, making them suitable for long-term wealth maintenance.

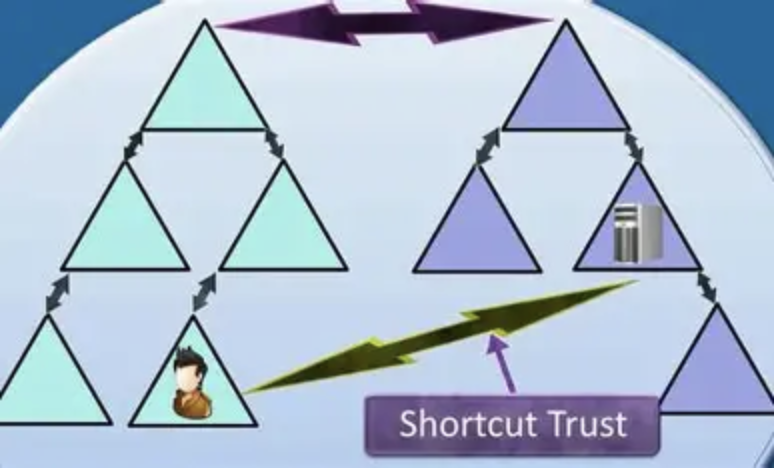

Dynamic Trust Structures for Flexibility

Traditional family trusts find it challenging to adapt to evolving regulations. Dynamic trusts, which permit changes to beneficiary terms and adjustments of jurisdictions, effectively respond to international policy modifications. For instance, a trust that can shift the governing laws can sidestep new tax obligations, whereas gradual asset distribution provisions can protect wealth from sudden economic declines or family emergencies.

Countercyclical Private Market Footprints

While many investors pursue booming sectors, uncertainty often rewards those who make countercyclical moves in private investment markets. Wealthy individuals can take advantage of distressed private equity opportunities in oversaturated industries or invest early in sectors that are resistant to economic downturns, such as healthcare technology. These investment opportunities, which are typically out of reach for retail investors, are likely to yield substantial returns as markets stabilize.

Cross-Border Compliance Wealth Shielding

Regulatory risks intensify amid global uncertainty. More than just basic tax optimization, proactive compliance strategies help protect wealth. This involves structuring assets with double-taxation agreements, revising beneficial ownership documentation, and ensuring that portfolios comply with changing anti-money laundering regulations. Such strategies can avert unforeseen asset freezes or penalties as policies shift.

Standard stress tests usually concentrate on market crashes, but the nuances of modern uncertainty require broader considerations—such as geopolitical sanctions, disruptions in supply chains, and currency depreciation. Customizing tests to account for these factors uncovers concealed vulnerabilities, enabling investors to modify their allocations before any crisis occurs. This forward-looking strategy substitutes reactive damage control with strategic preparedness.

Non-Financial Asset Hedge Mechanisms

The safeguarding of wealth encompasses much more than financial holdings. Key non-financial investments—like premium real estate in secure locations or prestigious memberships in influential worldwide networks—function as protective measures. These assets maintain their worth during market downturns and provide indirect access to new investment prospects, forming a safety net that endures through various market conditions.

In times of uncertainty, the resilience of wealth relies on adaptability and specialized knowledge. By integrating flexible structures, countercyclical strategies, and unconventional hedging methods, wealthy investors can maneuver through volatility effectively—not just safely, but with intention—transforming disarray into a driving force for lasting growth.